Developing a money mindset is crucial for achieving financial success and stability. A money mindset is essentially your attitude and beliefs about money, which influence your financial decisions and behaviors. By cultivating a positive money mindset, you can overcome financial challenges, make better financial choices, and ultimately achieve your financial goals. This guide will explore key strategies to help you develop a money mindset, including forgiving your past, changing your story, practicing gratitude, knowing your worth, believing in yourself, respecting money, taking small steps, sacrificing leisure, eliminating complaints, visualizing success, never stopping learning, and prioritizing action over excuses.

1. Forgive Your Past

Reflecting on past financial mistakes and forgiving yourself is the first step towards developing a money mindset. Holding onto guilt or regret can hinder your progress. Instead, acknowledge your mistakes, learn from them, and move forward. Understand that everyone makes financial mistakes, and each mistake is an opportunity to grow and improve.

2. Change Your Story

Your internal narrative about money significantly influences your financial behavior. If you believe you are bad with money, you are likely to make poor financial decisions. Start rewriting your story by replacing negative beliefs with positive affirmations. For example, instead of saying, "I’ll never be wealthy," say, "I am on the path to financial abundance." This shift in mindset can lead to better financial habits and outcomes.

3. Practice Gratitude

Cultivating gratitude for what you currently have can shift your focus from scarcity to abundance. Recognize and appreciate your financial blessings, no matter how small. This positive outlook can attract more opportunities and resources into your life. Practicing gratitude can also reduce stress and improve your overall well-being, making it easier to manage your finances effectively.

4. Know Your Worth

Understanding and acknowledging your value is essential for financial success. Recognize your skills, experience, and unique contributions. Don’t be afraid to charge what you’re worth or negotiate for better pay. Knowing your worth helps you make financial decisions that reflect your true value, leading to greater financial rewards.

5. Believe in Yourself

Self-confidence is a key component of a money mindset. Believing in your abilities to achieve your financial goals can motivate you to take the necessary actions. Use affirmations, self-reflection, and surround yourself with supportive people to boost your self-belief. Confidence can empower you to take risks and seize opportunities that can lead to financial growth.

6. Respect and Money

Treating money with respect means managing it wisely and making informed decisions. Understand the value of money and how it can work for you. Being organized with your finances, such as budgeting and planning, shows respect for your money and can help you grow your wealth. Respecting money also means avoiding impulsive spending and focusing on long-term financial goals.

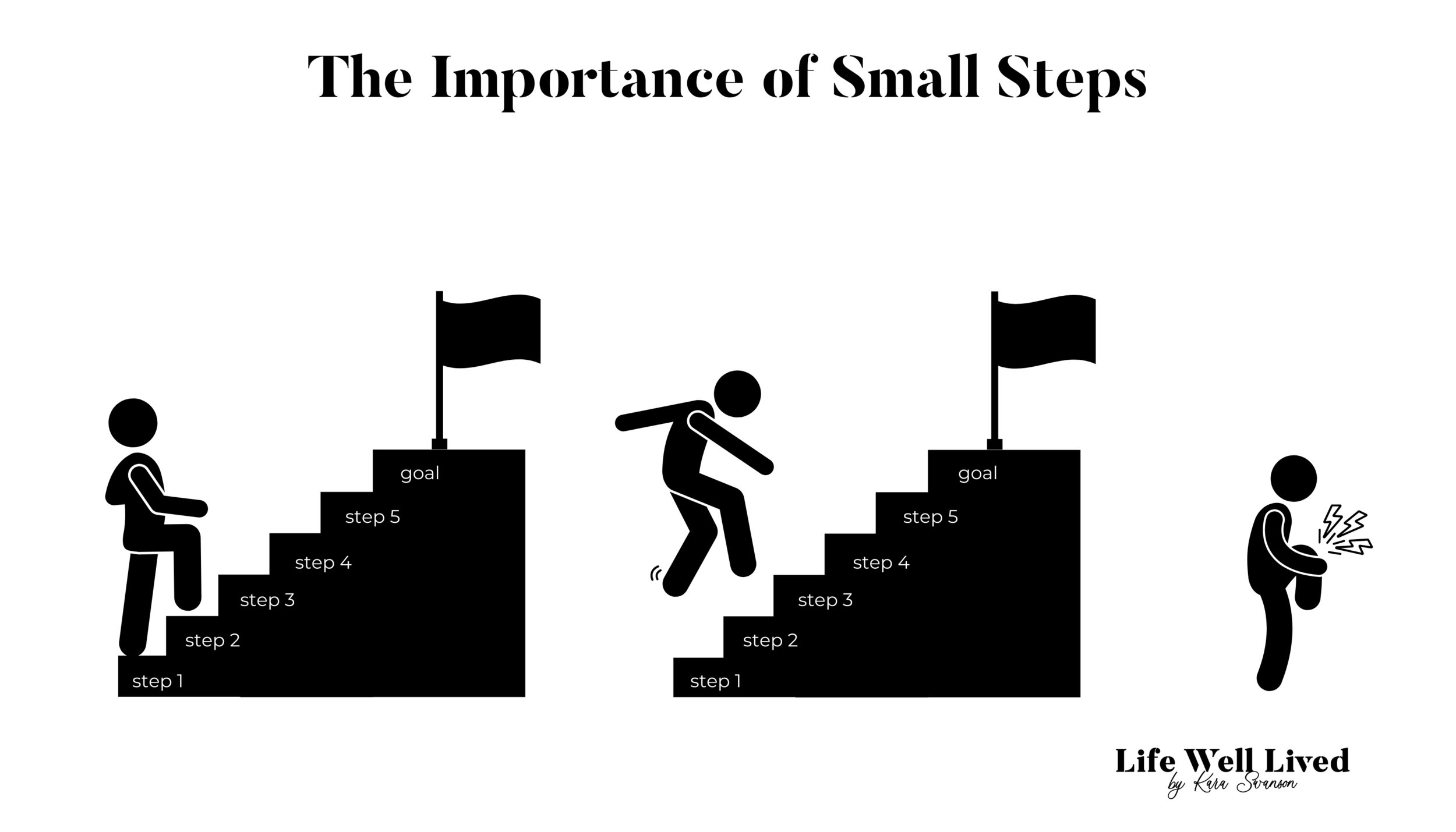

7. Take Small Steps

Achieving financial goals often involves taking small, consistent steps. Break down your financial goals into manageable tasks, such as saving a small amount each week or learning a new financial skill. Small steps can lead to significant progress over time, making large financial goals more attainable.

8. Sacrifice Leisure

9. No More Complaining

10. Visualize Your Success

11. Never Stop Learning

Continuously educating yourself about finances is essential for a money mindset. Read books, take courses, and stay informed about financial trends and strategies. The more knowledge you have, the better equipped you are to make wise financial decisions. Never stop learning, as this can help you adapt to changing financial landscapes and seize new opportunities.

12. Action Over Excuses

Prioritizing action over excuses is crucial for financial success. Procrastination and excuses are obstacles that can prevent you from achieving your financial goals. Commit to taking at least one action each day that moves you closer to your financial objectives. By focusing on action, you can overcome challenges and make steady progress towards your goals.

Putting It All Together

- Daily Affirmations: Start your day with positive affirmations that reflect your new money mindset.

- Set Goals: Define clear financial goals and break them down into smaller, achievable tasks.

- Track Progress: Regularly monitor your financial progress to stay motivated and make necessary adjustments.

- Stay Positive: Maintain a positive attitude towards money and believe in your ability to achieve financial success.

- Learn and Adapt: Continuously seek out new knowledge and be flexible in adapting to new financial strategies and opportunities.

By integrating these practices into your daily life, you can develop a strong money mindset that will guide you towards financial success and stability.

No comments:

Post a Comment